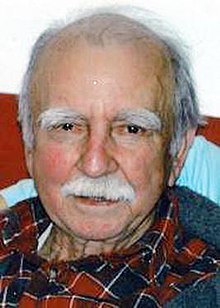

Last week, we talked about Earl Crawley, the parking lot attendant worth $500,000! This week we have another wealth story, Ronald Read, a Vermont gas station attendant, who died a multimillionaire. How did he do it? What made him a multimillionaire?

When Ronald Read died, he left an estate worth $8 million. He gave the majority of it to charity, his $8 million was held in property and stock holdings.

Unlike most people, Mr. Read didn’t feel the need to spend more than he made. Even whilst he worked as a janitor and a gas station attendant, he never bought a flashy car, never bought a large home, never flashed his ‘wealth’.

He was so good at this, that his friends and family didn’t even know he was a millionaire. He did this by living far below his means and investing as much as possible.

When Read died at the age of 92, his stepson told the Brattleboro Reformer “He was a hard worker. But I don’t think anybody had an idea that he was a multimillionaire.”

Read came from humble origins. He was the first in his family to graduate high school, and according to Reuters, he was a WWII veteran, having served in North Africa, Italy and the Pacific Theater. When he returned he worked as a janitor at JCPenny, as well as a gas station attendant.

He married and had two children.

Read maintained a frugal lifestyle until his death, he never spent money unless he had to.

He would often be seen driving his second hand Toyota Yaris, using safety pins to hold his coat together and chopping firewood even after he’d turned 90.

His friend Mark Richards said of him “I’m sure if he made $50 a week, he’d invest $40 of it.”

Read was also a good investor, he picked good stocks and held onto them for the long run, much like Warren Buffett does. According to the Wall Street Journal, Ronald Read owned at least 95 stocks at the time of his death, much like Earl Crawley.

Ronald Read invested in Blue Chip stocks. Including: Procter & Gamble, J.P. Morgan Chase, General Electric, JM Smucker, CVS Health, Johnson and Johnson, and Dow Chemical.

When Mr Read passed away in 2014, he left $8 million of his estate to the local library and hospital. Brooks Memorial Library said of the donation “It was the talk of the town.” The donation totaled $1.2 million. The library subsequently invested the money, that way it will pay dividends in the future.

Ronald Read also donated $4.8 million to Brattleboro Memorial Hospital, a place where Read was a regular. However, this was not for treatment, but for breakfast.

Ellen Smith said that Read always had the same thing, an English Muffin with peanut butter and a coffee, always sitting at the same stool.

The hospital will use the money to support infrastructure improvements and general modernization improvements. Guns Patterson said “There are multiple areas of the hospital in need of improvement, this money will certainly help.” She also said that the hospital was grateful and fortunate.

What can we learn from Ronald Read?

We can learn that no matter how old, no matter your background. You can become financially free and it doesn’t take a 6 figure salary to become financially free as some would have us believe.

Ronald Read and Earl Crawley are not alone. How are these people, who should be ‘poor’ and working until they drop dead, multimillionaires, when doctors and lawyers can’t even become financially free?

We can learn that no matter your excuse, you can become financially free, even when you might have been told otherwise. You can learn that investing is king. Start when you’re young, and when you’re old, you’ll thank yourself, rust me.

Forgo the luxuries, you don’t need them. Invest instead, you’ll thank yourself later.

It’s a growing trend. The “idiots” at school are financially free. The smart kids are the ones drowning in debt. I was a smart kid, I broke free.

My school told us the only way to make money, was to be a lawyer, doctor, engineer or other high paying job. I started my own business, I broke free.

How can I start investing?

Investing is simple. Finance Friday has an article on this topic in detail on the way, however, this is brief.

- Forget your 401K. If you work for a company, you may have a 401K. It’s essentially a retirement plan, where you invest in shares of the company you work for. Forget it, you’d be better putting your money in the market.

- Invest in what you know. What is your area of expertise? Transport? Media? Banking? Always invest in what you know. You should always be able to explain your business, in less than two sentences. Eg. Corporation X is an X their main source of income is X, followed by X, followed by X. Their largest competitors are X, X, and X. Always pick your niche, far before you consider investing.

- Pick your investments. You’ve picked your niche. Now pick your investments. Be careful. This will require research in your own time. Go through the financials. Is there a lot of debt? Is it an overly-volatile stock? Does it have history of growth? Are they being competitive? Look at the shareholder letters. The CEO sends a letter to the shareholders. Is (s)he being honest? Is (s)he telling you the good and the bad? If you want a stellar example. Read Berkshire Hathaway’s. It’s written by famed investor. Warren Buffett. If you can. Print them out. Keep them. Even if you don’t plan on investing in Berkshire Hathaway. When you are confident that the investment is sound. You’ll be set.

- Disregard your emotions. Don’t let your emotions cloud your judgement. If you have a spouse. Ask them to pick faults with the company. Ask questions. If you can’t answer them. Don’t invest. If you are lucky enough to have a friend or family member who deals with financials. Ask them to help you go over the balance sheet. (S)he will be able to show you faults in the balance sheet. If these are found. Keep your money out. Go back over the letters and balance sheet. Several times before you invest.

- Find a broker. Investment apps are the easiest way to start investing. Make sure that the stocks you want are available with that broker. If in doubt. Ask! When you find a broker. You can open an account

- Wait for the sale. Essentially you want to buy the stock. When it’s half price. It’s like buying $1. For 50 cents. When will the stock be on sale? Recession. Or the company makes a mistake. The market reacts. The price goes down. That’s when you go in. And invest when others are selling.

Do you think you can replicate what Ronald Read did? Would you want to?Tell me in the comments!