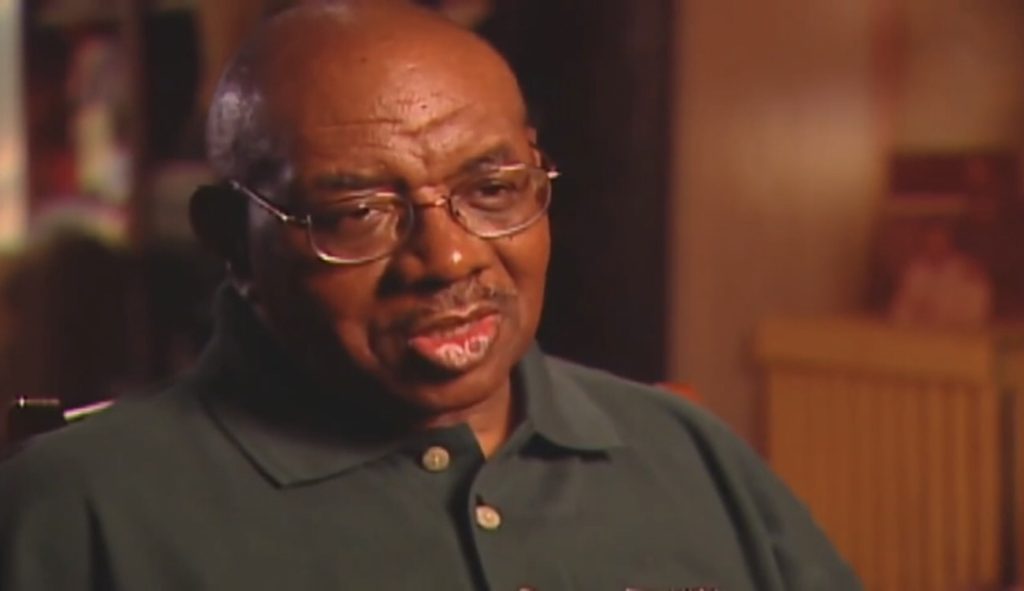

Someone who’s wealthy obviously has a high-paying job right? Wrong! This is a common misconception. You don’t necessarily need to have a high paying job. After all, Earl Crawley was only a parking lot attendant, for his whole life and he was half a million dollars!

How did Earl Crawley save up $500,000?

Short answer: saving little by little since he was young. Over time, this snowballed, which grew to over $500,000.

Early in his life, Mr Crawley knew he wouldn’t be able to land a high paying job. He was dyslexic, and found school quite difficult. As a teenager, he realized that the only way he’d be financially free, was to be frugal and save, save, save!

In almost four and a half decades Mr. Crawley has worked at the same parking lot. Where he made a mere $12/hour.

Despite this, Mr and Mrs Crawley were able to send their children to Catholic School, with both getting extra jobs to foot the tuition. (Now that’s hustling!)

Meanwhile, Mr. Crawley started to look for ways to invest. Investing little by little, every month, for 44 years. He was able to invest a small amount of his salary into savings stamps, which were used by the US government to fund WWI and WWII.

Once he had saved more money. He began to play the stock market. Investing in blue chip stocks, but only buying one or two stocks at a time. Earl Crawley credits his success to his diligence and self-control, he told MoneyBoss:

“Instead of taking dividends and pocketing them. I let it set- or let it reinvest itself. The more shares I had. The more dividends I had. So the more shares I had down the road.”

Mr. Crawley is now worth $500,000! Which makes him 10x as wealthy as the median American. According to Credit Suisse. While making less than half the median American income.

We felt the need to share this story after seeing it on theminoritymindset.com. It’s easy for many to blame their financial problems on not making enough money. While it may be a contributing factor, it should never be your excuse as to why you can’t be financially free.

Next time you go into a dealership and buy a shiny new car on finance, remember that $300 could be going to your investment portfolio. Yes, it may not be flashy, and your friends will poke fun at you. But you won’t be the one working until you drop dead…

How can I replicate what Earl Crawley did?

Ok, maybe you don’t want to spend 44 years working as a parking lot attendant. You might want to get a job that pays more. But the message is clear: live below your means. If you earn $1,500, live as though you earn $1,200 and Invest the extra $300.

After a few years, maybe you’ll be worth $500,000, just like Earl Crawley! And if I want to become a millionaire in less than 44 years? Earn more, spend less, live like you’re broke, and never forget: Invest! Invest! Invest!

How do I boost my income?

Whilst there is no end of answers to this question. Finance Friday would always recommend that you start your own business, Or at least a side-hustle. (If you can.)

Try to get your boss to give you a pay raise, even an extra $100 can do miracles for your investment portfolio. Keep on living below your means, if you can lower it, do it! You’ll thank yourself in the future and so will your bank account.

How long will it take me to become a millionaire from investing?

It depends on you. The more you invest, the shorter the time will be. Always invest in your means, and never borrow money to invest. If you do that, you may as well get yourself another credit card…

Always remember: Invest in what you know, and never stop investing. Warren Buffett has been investing since he was 26, he’s now 89, having only turned 89 recently.

Happy Birthday Warren, from all at Finance Friday!

Has the story of Earl Crawley inspired you? Are you currently trying to replicate what Earl Crawley did? Have you got another surprising wealth story that beats even the feats of Earl Crawley? Tell me in the comments!

1 Comment

James K. · March 24, 2020 at 4:09 pm

Hell yeah!

I’m so glad that someone has finally documented such a great accomplishment!

Earl certainly deserves his money for all his hard work! No one can deny that!

Comments are closed.