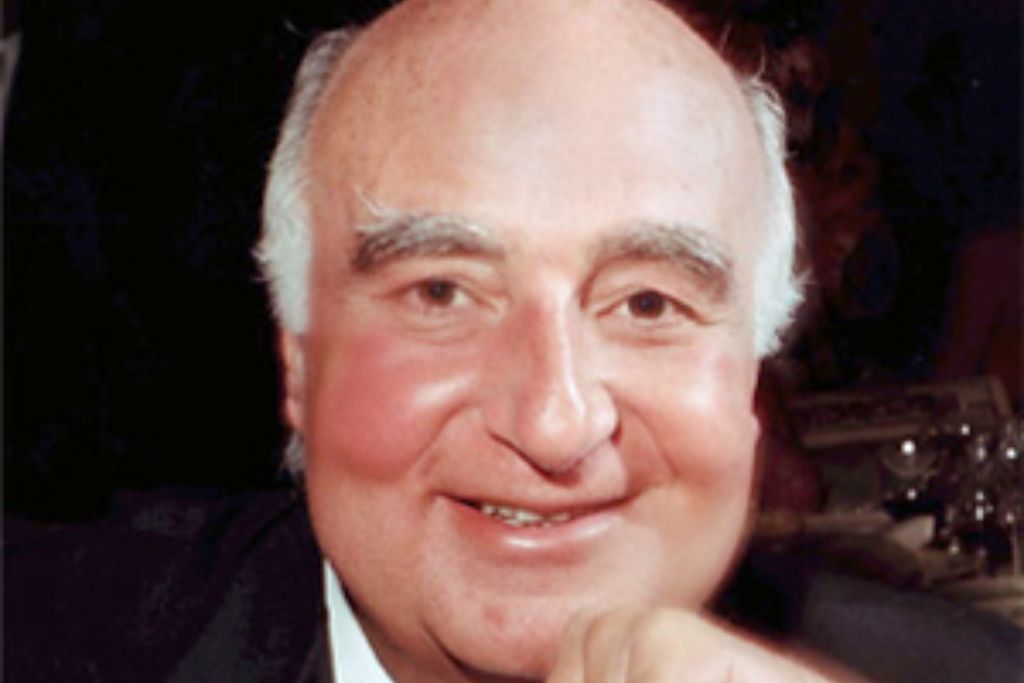

Though there are many who would claim that various members of the also Jewish Rothschild family hold this title, at least officially, Brazil’s Joseph Safra was the richest banker in the world prior to his death in December 2020.

The longtime chairman of the Safra Group and its associated companies, Joseph was a gifted banker who shrewdly invested his money to grow his banking empire, eventually foraying into real estate and produce too, all lending to his $22.6 billion net worth.

Ancestry

The banking origins of the Safra family go back generations; to the time of the Ottoman Empire to be precise.

From their base in Aleppo, the Safras, a family Sephardic Jews, initially made a fortune financing trade caravans between the Empire’s major cities and as money changers – exchanging Austrian Thalers, Ottoman Paras and Venetian Zecchini for their equivalent in gold and silver.

Well known for their ability to calculate and exchange large sums of money mentally, the Safras became quite successful and the family’s first bank, Safra Frères et Cie., was founded in 1840.

Thanks to their reputation as highly selective, yet dedicated financiers, the family added new offices in Istanbul, Beirut and Alexandria, only furthering their reputation internationally.

It was into this family where the family’s modern patriarch (and Joseph’s father), Jacob Safra, was born in 1891. Working in his family’s bank from an early age, Jacob himself quickly gained a reputation as a talented banker.

When the Ottoman Empire collapsed in 1922, Jacob moved to Beirut – a city with a thriving Jewish community – and founded Banco Jacob E. Safra in 1929 and worked to become a pillar of the city’s Sephardic Jewish community.

The personal banker to much of Lebanon and Syria’s rich Jews, Jacob handled their business and personal finances with the upmost care and discretion. Interestingly, the family’s name literally means “gold” in Arabic…

Prior to leaving Aleppo, Jacob was introduced to his cousin Esther Tiera Safra. Despite their 13 year age difference and familial relations, the pair fell in love and were married in the Lebanese capital in 1920, not long after Esther’s 16th birthday.

Early Life

Joseph Yacoub Safra was born on September 1 1938 in Beirut, Lebanon as the third of his parents’ four boys.

Growing up in the Arab-majority Lebanon as an affluent Jew in the 1940’s and 1950’s, when the state of Israel was only relatively new, Joseph (and the Safra family as a whole) faced much discrimination, especially after the 1948 Arab-Israeli War.

Due to this and thanks to his father’s large fortune, it’s believed that Joseph was sent to England to receive his education, though the Safras’ well-known reclusiveness means that they’ve never confirmed this.

By 1952, antisemitic sentiments had grown so large that the family feared for its safety and left Beirut for São Paulo and continued their financial business there, following a much larger wave of Jews fleeing the hostile Arab world for the more tolerant Brazil.

Arriving in Brazil, Joseph’s father and older brother, Edmond, continued the family business by financing the projects of wealthy Brazilian Jews.

After completing his education, it’s believed that Joseph did a brief stint at Bank of America to gain some practical banking experience, only returning to Brazil in 1963 in the wake of his father’s death.

Now in business with his older brother, Edmond, and younger brother, Moise, the three Safra brothers continued financing new projects for Brazil’s wealthy Jews. Joseph, however, wasn’t satisfied just being a financier: he yearned to be a banker.

Banco Safra

His hope was that he could convince his two brothers to turn the family’s financing company, into a fully-fledged bank. Though both brothers entertained the idea, Edmond and Joseph fundamentally disagreed on how they should do this, creating a rift between the two.

Eventually, this rift caused Edmond to leave Brazil for New York and establish the Republic National Bank of New York in 1966.

With this, Joseph and Moise were free to officially create Banco Safra that same year (though the bank considers its founding date to be 1955 – when the Safras first started financing assets in Brazil), with each brother owning 50% of the bank.

Focusing on corporate banking, Banco Safra became the bank of choice for much of Brazil’s wealthy entrepreneurs. As the bank’s client base grew, Banco Safra began to offer more services including personal banking, asset management and insurance to name a few.

To acquire more clients, Joseph Safra took a page out of Amadeo Giannini’s book by acquiring smaller rival banks and/or opening new branches in strategic areas, continuing until a large portion of the Brazilian population live in the vicinity of a Banco Safra branch.

However, unlike his ancestors who’d run the day-to-day operations of their banks, Joseph wasn’t the CEO (or a similar role) of Banco Safra. Instead, he was the chairman, basically making him the ceremonial head of the company.

This allowed Joseph Safra to preside over Banco Safra’s international expansion – both through international branches and foreign subsidiaries – whilst appeasing regulators (who often don’t like bank CEOs holding multiple international CEO positions).

As of the time of writing, Banco Safra has over 130 branches worldwide, over 100 of which are located in Brazil alone, making it the sixth largest bank in the country.

Safra Group

The Safra brothers also expanded internationally by strategically adding international subsidiaries in places like Switzerland, the Caymans and New York.

Privately owned by the two brothers, Joseph Safra came up with the idea of creating one company to represent their network of banks. He called this Safra Group.

However, Safra Group isn’t a traditional bank holding company: it doesn’t own shares in the individual banks it calls subsidiaries (those shares are owned by the Safra brothers), instead it acts more as an official entity for their network.

And this is a stroke of genius of Joseph Safra’s part.

By doing this, Joseph gave his banking network a legal entity, allowing him to consolidate his holdings under one umbrella without officially consolidating them, and putting all capital requirement into one place.

In so doing, this has allowed the Safra brothers to expand their client base (locations, assets under management etc.) with much less risk than their competitors have.

Without this structure, it’s likely that the 2013 merger of Bank Sarasin and Bank Jacob Safra Switzerland would’ve never gone ahead due to regulatory scrutiny. With it, however, the group was able to easily merge the two giants into Switzerland’s sixth largest bank.

In 2006, Joseph purchased his brother Moise’s shares in the various Safra-owned banks worldwide for an undisclosed sum, making Joseph Safra the sole owner of the Safra Group and its various banks.

Property Mogul

Hoping to diversify the Safra Group’s holdings away from just banking, Joseph Safra spearheaded the group’s foray into real estate investing: an industry he said had great potential. Even after the housing bubble burst.

To begin with, the group bought up commercial real estate in Brazilian cities like São Paulo and Rio de Janiero, mostly under the radar, then leasing or renting it out for a profit.

Following a Buffet-esque investment philosophy of buying fair real estate at a great price (with the knowledge it will increase dramatically in value), it wasn’t long until Safra Group became one of the largest landlords in the country.

Now with few, if any, prospects left in Brazil, the company expanded abroad.

Focusing on British real estate, Joseph Safra and Safra Group made headlines in 2012 when they purchased One Plantation Place (now called 30 Fenchurch Street) in the heart of London’s financial district for £500 million.

Two years later, Safra again made headlines for purchasing another London landmark. This time, he (through Safra Group) paid £700 million for the 590 foot skyscraper, the Gherkin (30 St Mary Axe) also in London’s financial district.

Other London real estate acquisitions include 47 Berkeley Square (also in London’s financial district) and 144 New Bond Street, housing the Halcyon Gallery, the latter of which he sold for £130 million in February 2020.

Outside of London, Joseph Safra/Safra Group acquired commercial real estate in other major cities like New York and Geneva, also with the intention of leasing/renting them out.

Various members of the family also purchased residential real estate in New York formerly owned by the Astor family.

In December 2020, Safra Group’s real estate portfolio was valued at $2.3 billion.

Chiquita

In 2014, the board of banana producing giant Chiquita announced it would be merging with rival Fyffes plc to form a joint-stock company called ChiquitaFyffes. By all accounts, the merged company would’ve been the largest banana producer on the planet with projected revenues of $4.6 billion.

Sensing an opportunity, Joseph Safra’s Safra Group joined forces with Brazilian orange giant, Cutrale, to place a $611 million takeover offer for Chiquita (substantially more than the $526 million Fyffes we’re offering).

Despite their higher offer, the Chiquita board rejected the offer outright and refused to meet with Safra and Cutrale to discuss the bid.

However, when it came time for Chiquita’s shareholders to vote on the merger, they voted against it and accepted the Safra-Cutrale offer instead.

As his Safra Group was putting up half the money for the acquisition, whilst Cutrale put up the other half, Safra Group and Cutrale both owned 50% each, in effect making Chiquita a joint-venture between the two Brazilian giants.

Later Life & Death

As he got older, Joseph Safra became an even more generous philanthropist, donating heavily to Jewish causes (usually the construction of new synagogues), the poor and war victims.

Even as he reached his seventies and eighties, Joseph remained in charge of his empire, routinely working through nights, weekends and holidays and gaining a reputation for being a workaholic. He wouldn’t even vacation with his family.

Sadly, his “work hard, no play” lifestyle took a toll on his health and he was diagnosed with Parkinson’s disease.

Like his brother, Edmond, Joseph was incredibly secretive and paranoid, surrounding himself with Mossad-trained bodyguards to prevent anyone from harming him or his family as a result of his immense wealth.

On December 10 2020, Joseph Safra died of natural causes in his São Paulo home at the age of 82. His death was announced jointly by his family and company later that day on social media and via obituaries in finance-oriented media outlets.

Prior to his death, Joseph was called the “Last Safra standing” as he was the only one of his three brothers still in business – Moise became a non-executive director after being bought out whilst Edmond was murdered in December 1999.

At the time of his death, Joseph Safra was the richest man in Brazil, with a net worth of $22.8 billion according to Forbes.

Though his will has been contested in court due to his Parkinson’s disease, Joseph left his entire fortune to his family, with his wife, Vicki, getting the lion’s share with $7.5 billion, whilst their four children split the remaining $7.5 billion equally between them (after tax).

With his passing, two of his sons have taken control of the company. His eldest, Jacob J. Safra, currently runs Banco Safra’s international operations, whilst his youngest son, David, runs its Brazilian operations.

His only daughter, Esther, married Carlos Dayan, the only son of Brazilian banker and Banco Daycoval co-founder Sasson Dayan.

Joseph Safra’s other son, Alberto, currently owns/runs São Paulo-based investment manager ASA Investments, having left Banco Safra in October 2019 following a dispute with his brother Jacob, over the latter’s expansion into retail banking.

Has the story of Joseph Safra inspired you? Tell me in the comments!