I’m sorry to say people, a recession is coming, whether we like it or not. You can financially prepare for a recession, but chances are, you doing it wrong.

How are you doing this wrong? You are probably doing what everyone else does- keep investing, start eliminating your debt, and trying to cut down costs.

Yes, these are good pieces of advice and all (and which you should follow if you can), but they aren’t what’ll make you a millionaire (or even a billionaire) during the next recession.

More millionaires and billionaires are made during recessions than are made during bull markets- why not take advantage of this?!

15. STOP investing

Yes, you heard me. Contrary to what sites like Forbes will tell you, you should not keep investing while you are starting to prepare for a recession.

When there is a recession on the horizon, the stock market is usually way too high! The same can be said for the bond market, real estate market and just about every other market in the world!

If you do want to keep investing whilst preparing for a recession, that’s fine. Just know, that according to rule one investing, you should always be searching for a dollar bill that is retailing at fifty cents. But what if you can get that fifty cents at a reduced rate of say twenty-five cents? Or even ten?!

You don’t have to be a math professor to know that getting something at twenty-five cents a piece rather than fifty is a much better deal!

Obviously, if you are trying to contribute more to your 401(k), this would be a bad idea. (Although, most of the time, it’s recommended that you try the market rather than making the most out of your 401(k) though!)

14. Start learning new skills

This either stumped you, or made complete sense straight away. You can prepare for a recession by learning new skills. I’m talking literally anything, whether it’s a foreign language, poetry, graphic design, cooking, writing or whatever!

During a recession, these life skills will serve you well!

Why?

Because chances are, that unless you run your own business, are a high level (and vital) company executive or do a really niche job where you are one of only a few experts. It’s likely that you could lose your job.

Prepare for a recession (and the potential that you might be laid off) by working smarter, not harder.

Many others will similarly get laid off during the recession. Those businesses or government agencies that can offer jobs in the recession, will be absolutely bombarded with applications.

Rather than focusing on that being your only salvation, prepare for a recession by learning a new skill that you can sell during a recession.

Know a foreign language? Recessions often boost sales for translation agencies, so try doing that! Know how to do graphic design? Great! Companies will be looking to lay off their graphic designers to outsource them to freelancers.

Instead of sitting there worrying if the next lot of lay offs will have your name. Have a plan. And an actionable one at that!

13. Meditate

“What on Earth?!” Yes, meditate. I don’t care if it’s boring, I don’t care if you can’t do it (seriously, there’s like a gazillion YouTube videos on it!) I don’t care if you haven’t got time for it, find some!

Meditation is often one of those things that people think is silly, yet is super effective!

If you are trying to prepare for a recession, take a few minutes each day to meditate. It can be at home, it can be in your office, it can be in your car for all I care, I doesn’t matter!

And don’t forget to do it everyday!

But how does this help you to prepare for a recession? Short answer: it doesn’t. Long answer: it doesn’t, per se.

Meditating won’t directly help prepare for the next recession, but it will focus your mind.

By focusing your mind, it allows you to see everything clearer, rather than seeing everything through a sort-of cloud. It allows you to step back and have a look at your master plan.

Is it going to plan? If not, where do you need to alter it?

12. Make a plan (and write it down!)

I am a big advocate of writing down your financial plans. Whether you are planning to save, invest, eliminate debt, plan for retirement or a recession, or even just making a budget! You need to write down your plan!

However, most people fail one key step: the writing itself.

Most people think that their plan needs to be really detailed, with diagrams and several pages long. This is how not to write your plan.

The best way to write your plan is to be vague, yet convincing. Much like a politician in many ways (without getting too political about it!)

- Don’t go too far in detail where it becomes that everything needs to go 100% to your prediction, for your plan to work

- Just outline the main point and move on

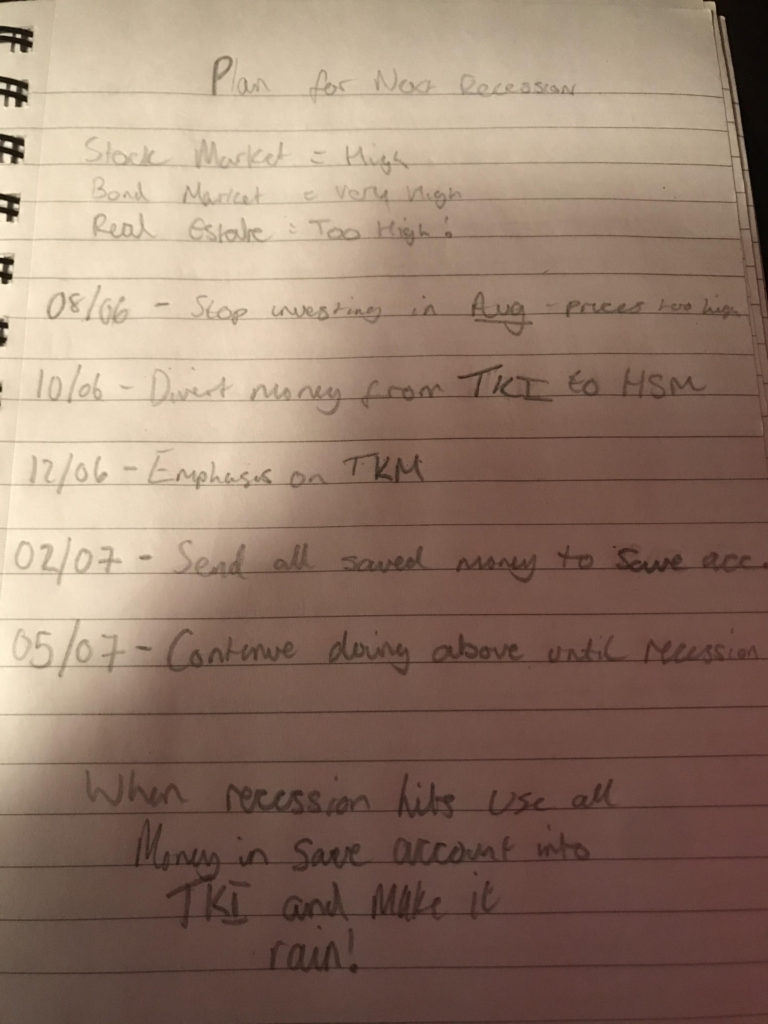

Take for instance, this photo of a plan I wrote for the 2008/09 recession:

(For reference: TKI is my investments company: HSM is a business I own; TKM is a business I own (all acronyms, obviously)

If you can write a plan correctly, you can prepare for a recession really easily! Essentially, all you are doing is making it so that you can see a visual representation of the plan you have been meditating on (and the one that’ll make you rich!)

11. Read!

Warren Buffett reads every single day. So does Mark Cuban, so does Charlie Munger, so does Elon Musk. And the list of billionaires who read goes on and on!

What you read doesn’t have to be on personal finance, it could be on literally anything! It doesn’t even have to be books either! Thanks to the introduction of the internet, you can now read whatever you like, on the internet, for free!

Whether that is the latest aviation news, financial analysis, political opinion or just a great Harry Potter book, it will do.

How does this help you to prepare for a recession? Just like meditation, it allows your brain to focus. Whilst you are reading a great book, or a great article, your brain is working in the background.

It is working out extra contingencies, it is working out everything! And the best part is, that you can do three things on this list in one if you think about it!

(PS: Just because your brain works the same during meditation as when you are reading, do not discount meditation. Both are vital)

10. Get educated

This could tie into your reading if you think about it.

You can read a good book/article on whatever you need to educate yourself on. Thus, you are doing two key points at once!

What do I need to get educated on?

- Money

- Finance

- Business

- Investing

- Your area of expertise

- Any areas you’d like to become an expert on

You can never know enough about any of these categories. I don’t care how much you may disagree with this statement, it is true, no matter how much we hate to admit it!

How can I educate myself on these topics?

- Books– by far the most traditional way, and by no means any less actionable than anything on this list

- Internet– for money, business, finance etc. you can read our site, there are also hundreds of others to choose from as well! For your area of expertise, there are usually websites dedicated to your area of expertise (even if it is basket weaving!)

- Industry publications– most industries have their own industry-specific publication that is like the Bible for that industry, if you can get your hands on it, do it!

How does this help you to prepare for a recession?

This helps you to prepare for a recession because it allows you to know what others don’t.

In regards to finance, business, money, investing etc. It allows you to save an extra ace up your sleeve when you are investing. Not all investors will know certain bits of information, certain bits of information that you can use to get a hand over your competition!

In regards to your area of expertise, it’s what you should be investing in. So, you need to know what’s going on in that industry. Is a major player about to file for bankruptcy? Is there a new company on the horizon? Is the industry about to go into a major boom/depression never seen before?

If so, you need to know about it!

9. Bulletproof your portfolio (get rid of dead weight)

If you have an investments portfolio of any kind, now might be the time to look at it and reassess.

Which investments do you plan to buy more of? If so, don’t touch them whatsoever.

Which are massively overvalued? You might want to think about selling your stake in them now.

Which are the proverbial “dead weight” of your portfolio? You should definitely be thinking of dropping them from your portfolio now, whilst the price is high!

By doing this, you are probably doing the most sensible thing from an investor’s point of view. This helps you to prepare for a recession as it allows you to align your plans, your expectations and your reality all in one fell swoop!

8. Save! Save! Save!

When you are starting to prepare for a recession, the question of whether you should save or invest is not something that you should be asking yourself.

When preparing for a recession, your main goal should be to save your money. Going back to our “How many bank accounts should you have?” article, we talked about having an account for saving/investing.

Instead of sending your money to your investments portfolio, you should now be keeping this money in the savings account so that you can benefit from a little bit of interest, as well as your preparation.

This will also help you to prepare for a recession as this money can be used as an emergency fund if necessary. Because, as I said earlier, you will probably have a high chance of being laid off during the next recession!

7. Work harder

Remember how I told you to work smarter, not harder?

Now do the opposite.

Before, I was talking about learning new skills to help make you money if you are sadly laid off. This time, I’m telling you to work harder at your day job.

When companies are in financial difficulty, such as a recession, the first people to go are:

- The newest hires

- The oldest employees

- The mediocre employees

Sadly, you can’t help the first two, but you can with the last.

If you are currently operating at “average” efficiency, now might be a good time to step on the gas and get working harder. Yes, that might mean putting in longer shifts, working weekends and the like.

But it is worth it if you can make yourself a vital employee, one that the business can’t afford to lose.

6. Decompress your lifestyle

“Living below your means is the key to wealth” is a key quote from Warren Buffett. If you’re already doing this, go further. If you’re not, you’ve got a long way to go!

If you are currently making, say $2000 per month, and living off, say $1600 of it. Now would be the best time to look at your budget and reassess it. Do you really need everything on there?

If you were to forgo that one expensive habit, or that on expensive hobby, or that Netflix subscription, or whatever it is, would it kill you? If the answer is no, then you should surely get rid of it, even if it’s only $10.

It all adds up in the long run.

Let’s say that you were to give up your Netflix subscription at $16 per month, and the recession doesn’t happen for another twelve months. That is an easy $192 extra for your investments portfolio when the recession hits!

Seeing as how, during a recession, the average stock is at a quarter of its original price, it means that once the market recovers, that extra $192 could’ve grown to almost $1000 by the end of things!

Not too bad for twelve months of no Netflix!

5. Get rid of high interest

If you really want to prepare for a recession, you have to target your debt. But, don’t just target your debt blindly. Target it as though you are getting rid of the worst first.

Many people advocate a “get rid of the largest debt” mantra, whilst this is perfectly ok, it isn’t necessarily the most effective.

Try to get rid of the highest interest debts first.

When you are saving, split the money in two. One lot, goes straight into the savings account for you to invest at a later date. The other half, goes straight into your “paying off debt” bank account, to pay off that debt.

How does this help you to prepare for a recession? During a recession, people are defaulting on debts all the time. No matter where you are, people will default on their debt, and whatever assets they have will be taken by the company that owns their debt.

What is often the cause of their default? High interest debt payments.

It’s not their two percent interest loans that cause the issue, but often mega loans with massive interest attached to them. These debts are things like credit card payments and payday loans.

By paying these off, you are inadvertently preventing these companies from coming after you during a recession.

(Some debt companies like to come after debtors during recessions in order to prop themselves up during a recession, as they know people would rather give away assets than go to court during a recession as they don’t have the money for it (which is illegal, but still happens!)

4. Build streams of income

Millionaires don’t have one single stream of income, and neither should you!

If you want to prepare for a recession, and the potentiality that you may lose your job, you might want to consider building a second, third or even a fourth stream of income.

This can be done through a multitude of mediums, such as:

- A blog with advertisements on it

- Selling your photos (stock photo sites)

- Creating an app

- And so much more!

Why would this help you when you prepare for a recession? Naturally, this is meant to make it so you can save more from your job, and have a backup if you do, unfortunately lose your job.

It’s also a good thing to have in general anyway!

3. Review your plan every six weeks

So, you’ve made your plan of what you need to do, both before and during the recession. However, as with everything, things happen and new information becomes available.

Sometimes, this new information opposes what you have written on your plan.

For example, when I was writing my plan for the 2008/09 recession, there was a house up for sale near where I lived. As a resident of the local area, I knew that it would go up in value once the markets sorted themselves out.

This was due to a plan by the local council to invest a significant amount into the local area, including building a new supermarket, main road and upscale housing.

The plan was meant to go through final approval in February 2008. When it did, the housing bubble had just crashed in the UK and as such, the local council abandoned the idea.

This ruined my plan to finally invest in real estate (something I plan to do this time round in the next recession!) Plus, the house I had planned to buy got sold in early December 2007, as the housing bubble collapsed in late December/early January.

How does this help you to prepare for a recession? It’s simple really, you stay up to date with the local goings-on, both locally, nationally and internationally. And every six weeks, you make sure that nothing is going against your plan!

2. Wait it out

Once you have done everything else to prepare for a recession, you can wait it out.

Remember, you can’t control the market, neither can I, neither can Warren Buffett.

As long as you have done everything else you can to prepare for a recession, you now get to wait it out.

Don’t forget to keep reading, staying up to date, learning new skills, making new sources of passive income and so on. And especially, don’t forget to review your plan every six weeks.

Use this waiting period wisely. If you are still unsure about anything, now is the best time to ask. If you can, try to find it out online, if you can’t, then it’s probably best to seek out a professional in your local area.

(Simply as they’ll know all of the local laws, regulations, exemptions etc.

1. Enjoy yourself

We’ve focused on the best ways that you can prepare for a recession, but we’ve missed out one key feature: be yourself and enjoy yourself.

It’s quite easy to get wiped up into a frenzy over this. With you pulling all-nighters over an idea to make an extra stream of income, that doesn’t work out. Or you becoming overly compulsive about every single penny you spend.

Whilst a little bit of that is good, and even financially healthy, too much of this will make you ill, and potentially even hospitalize you. Which is not good.

If you’re lucky enough to live in a country with free healthcare, you miss a few days of work and have a massive pile of work to do when you get back.

If you aren’t lucky enough to live in a country with free healthcare, it could bear deep into your emergency fund, and ultimately harm you trying to make money from this recession!

How else will you prepare for a recession? Tell me in the comments!