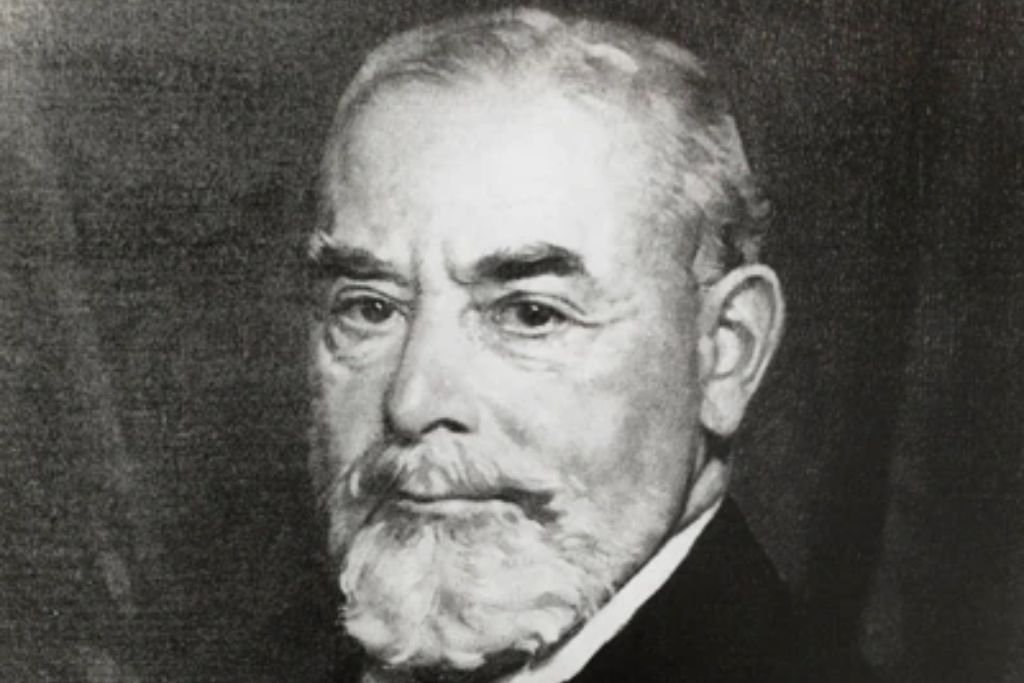

Though Marcus Goldman is the more famous of the two name partners behind Goldman Sachs, it was Samuel Sachs who turned it from a single office operation into a firm with a global reach and hundreds of clients across the country!

A pioneer, Samuel Sachs redefined the term “investment banking” by adding new aspects to the business and placing Goldman Sachs at the forefront of that change.

Early Life

Samuel Sachs was born in Baltimore, Maryland on July 28 1851, as the second eldest of five children born to Bavarian Jewish immigrants Joseph Sachs, a boarding school headmaster, and his wife, Sophie Baer, the daughter of a wealthy Würzburg goldsmith.

Among his four siblings, Samuel counted educator and founder of the Sachs Collegiate Institute (now the Dwight School), Julius Sachs, and neurologist/physician Bernard Sachs, both of whom became noteworthy in their own right.

Though the family was not poor by any means, Samuel started work at the age of 15 as a bookkeeper at a local store and later ran a small boards, glass and mirrors business during his twenties.

It was here where he met Philip Lehman, the son of Lehman Brothers co-founder Emanuel Lehman, and who would later take control of the firm in 1901. Despite their wholly opposite origins, the two would become lifelong friends.

Growing up, Samuel had been close with Louisa Goldman, the youngest daughter of New York-based investment banker Marcus Goldman, his father’s childhood best friend and the head of Marcus Goldman & Co.

After a long courtship, the couple were married in 1882. And the rest, as they say, is history…

Goldman Sachs

Known for his overly conservative approach to business and extreme attention to detail, not to mention being his son-in-law, Marcus Goldman invited Samuel Sachs to join his firm not long after his marriage to Louisa.

Accepting his father-in-law’s offer despite having no formal banking, Samuel picked up the trade quickly and had a personal aim to increase the firm’s standing within the industry itself and its reputation with its clients.

He firmly believed that the company should expand based on prior successes. In his world, new clients should come based on recommendations from old clients satisfied with their services, thus saving the firm massively on advertising.

To reflect his joining the company and the central role he played in its management, the firm was renamed M. Goldman & Sachs later that year. Six years later, in 1888, that the firm changed its name once again, this time to Goldman, Sachs & Co. The name Goldman Sachs wasn’t officially adopted until 1904.

At the time, Goldman Sachs was not the powerhouse it is today.

Instead of offering a broad range of services as they do now, the company was mostly a broker of commercial paper – essentially IOUs issued by corporations to finance projects – helping companies issue them and ultimately sell them to investors.

In fact, the money from brokering the sale of commercial paper accounted for almost all of the company’s revenue during the late 1880’s and early 1890’s.

And whilst Samuel Sachs was undoubtedly committed to continuing the company’s commercial paper activities, from a business point of view, it made the company susceptible to bankruptcy if the commercial paper industry ever collapsed.

Samuel’s idea was simple: remain committed to commercial paper, but slowly expand the company into major capital markets, such as over-the-counter (OTC) and bond trading, both of which are still huge sources of revenue for the company today!

Later Life

Ever on the lookout for new ways to best serve their clients, during the late 1890’s, Samuel Sachs began to notice that American companies were struggling to expand abroad. It wasn’t that they couldn’t raise capital, it was the acquisition process itself that prevented them.

Realizing that Goldman Sachs could never truly serve its clients by only staying in the US, Samuel Sachs reached out to British merchant (investment) bank Kleinwort, Sons & Co. in June 1897 (via a New York agent of the Rothschild family) to build a mutually beneficial, transatlantic partnership.

Goldman Sachs would help Kleinwort, Sons & Co.’s British clients with their US expansion, and they would help Goldman Sachs’ US clients expand to the British market. It was a win-win for both firms.

Going further than that, Samuel Sachs also developed contacts with investment banks in France and Germany too, in effect establishing the firm’s first international presence and paving the way for its eventual international expansion.

When Marcus Goldman retired in 1900, he left the firm in the hands of his son, Henry Goldman (who was made a partner in the firm) and son-in-law, Samuel Sachs, two more than capable bankers but men who despised one another personally due to Henry’s belief that his father preferred Samuel over himself.

Not surprisingly, this led to lots of rivaly and disagreement between the two, not only because they disliked one another, but also because of their wholly different approach to banking – Henry was a brash risk taker, whilst Samuel was more conservative, wanting to maintain the firm’s reputation.

Initially, this seemed like a master stroke on Marcus Goldman’s part: The two were so busy trying to outdo one another that the firm almost split in two whilst still being under the same roof and as a whole, grew immensely.

However, when Marcus died in July 1904, he stipulated that Henry should be made a senior partner and officially the co-leader (before, it had just been informal), in effect making him Samuel Sachs’ equal. And this is where it all went down hill…

Before, it had mostly been a friendly rivalry, with Henry constantly trying to prove to the other partners that he could fill his father’s shoes and Samuel trying to prove the same. In this scenario, everyone won.

As equals, however, they constantly undermined one another, and partners routinely switched their allegiance to the other co-leader. All this made it hard for the firm to appear united, and it slowly lost clients as a result.

Thankfully, WWI put an end to this. As a second generation German immigrant, Henry Goldman was incredibly pro-German. The only problem was, that the USA was fighting Germany and US banks were bankrolling that fight.

Goldman prevented Sachs from joining other banks in their financing of the war. Worst of all, he regularly made his pro-German stances known, something which harmed the firm more than anything else.

Because of this, pressure from the other partners, including Samuel Sachs, forced Henry to resign in 1917. This move, in effect, gave the Sachs family complete control over the firm, until Waddill Catchings joined the firm in 1918.

Samuel remained at the firm until 1929, overseeing the launch of the firm’s first closed-end fund, the Goldman Sachs Trading Corp., in December 1928, a fund that later failed when the stock market crashed the next year.

Partnership With Philip Lehman

Though Goldman Sachs and Lehman Brothers had grown to become rivals by 1906, Samuel Sachs remained close friends with Lehman Brothers managing partner, Philip Lehman, his childhood friend.

In fact, in that year, the pair sat down and devised an alternate method for large corporations to raise funds they needed, without issuing more debt.

Known as stock issuance, it allowed the owners of large corporations to sell a percentage of their stake in the company by issuing new stock (also known as equity) to be traded on the open market, just as their bonds were. This allowed many of them to expand more rapidly with much less risk.

Today, stock issuance is one of the main ways corporations raise funds, used by companies from Apple, to Google to Tesla, to even Goldman Sachs themselves!

To prove this would work, the pair got their two companies to partner together to bring the General Cigar Co. to the market. Just as they thought, it was a resounding success and the two companies continued their partnership to repeat this with a string of other customers.

Among these were Sears, Roebuck & Co, F.W. Woolworth Company, R.H. Macy & Co, Gimbel Brothers and Studebaker among others.

Death & Legacy

In 1924, Samuel Sachs donated $50,000 (roughly $800,000 adjusted for inflation) to Harvard University, a university whose business school has educated many members of the Goldman-Sachs family and many more Goldman Sachs employees.

Samuel Sachs passed away in his New York City home on March 2 1935, and was buried in the Salem Fields Cemetery in Brooklyn, New York. He was survived by his wife, Louisa, and four children.

His wife Louisa, passed away in 1949 and was buried next to her husband. In 2021, Goldman Sachs launched its own internal networking system (somewhat akin to LinkedIn) and named it “Louisa” in honor of Louisa Sachs.

Their two sons, Paul and Walter, both became partners at Goldman Sachs during Samuel’s lifetime. Paul later went on to become a renowned investor and museum curator, whilst Walter led the firm through the Great Depression.

Several of Paul and Walter’s own children have likewise become partners in the firm, ending with Peter Sachs’ stepping down from the firm in 1990, 121 years after the firm was founded and 108 after Samuel Sachs joined the firm!

Has the story of Samuel Sachs inspired you? Tell us how in the comments!

Featured image courtesy of Goldman Sachs.