Whilst not necessarily the most famous investor of all time, Mohnish Pabrai is certainly one of the best. By his early thirties, Pabrai had conquered two completed different industries: IT and finance.

Originally starting out as an IT company executive, Pabrai soon sold his company and turned his gaze to investing. The latter of which has made him both extremely rich, and somewhat famous!

Early Life

Mohnish Pabrai was born in Bombay (Mumbai), India on June 12 1964. He was fortunate enough to be born into the upper echelons of Indian society, which allowed him to attend an exclusive private school in the city.

Being from the upper classes, Pabrai lived in a nice neighborhood, ate good food, and always had clothes to clothe himself with. Here, Pabrai lived in a very sheltered environment, with him only interacting with other rich kids.

Just down the road from his fancy private school was the local slums. From his school, he could see the slums and the “Untouchables” who lived in them, and the open sewers that run just by their houses.

Despite it being so close to his school, none of his teachers or classmates ever seemed to mention it. This deeply impacted Pabrai, and would later set the stage for his charitable foundation, which would be founded thirty years later.

Mohnish Pabrai graduated from school in 1983. Here, his grades were good enough to get him into an American University, where he chose to study computer science at Clemson University.

In 1986, Pabrai would graduate from Clemson University suma cum laude. Following this, Pabrai would work for Tellabs, in Chicago. Here, he’d work in its high speed data networking division and later, in its marketing and sales division.

Entrepreneurship

However, working as an IT technician and later, as a salesman, was not Pabrai’s dream. Instead, he wanted to be an entrepreneur, and become extremely rich, something he’d work in his down time, starting in 1990.

TransTech, Inc.

In 1991, Pabrai quit working at Tellabs and decided to start his own business. He called this business TransTech, Inc. and was originally based out of his house in Chicago.

Due to this, Pabrai dropped out of doing his masters at the Illinois Institute of Technology, as he would no longer require it. This was also done because he didn’t have time to study and attend classes, whilst running TransTech.

To fund the business, Pabrai needed $100,000. Pabrai would fund this himself, using $30,000 from his 401(k) and a further $70,000 from his credit cards, which had a very generous limit.

TransTech was an IT consulting and systems integration company. Originally, Pabrai ran the entire company from a spare room he used as an office, but the company soon outgrew being a one-man operation.

Within its first few years of operations, Pabrai had enough revenue to pay off his initial credit card debt in its entirety. At the same time, Mohnish Pabrai had grown to need a large office in the center of Chicago.

In 1996, TransTech was recognized in the Inc. 500 fastest growing companies.

Four years later, TransTech had 160 employees, and was one of the largest companies in its industry. Due to this, it caught the attention of consulting giant, Kurt Salmon Associates, who purchased the company for $20 million.

Pabrai Investment Funds

By 1999, TransTech had grown to the point where Pabrai didn’t have to be actively involved in the day-to-day operations of the company. With this, he began to look for ways to become an investor.

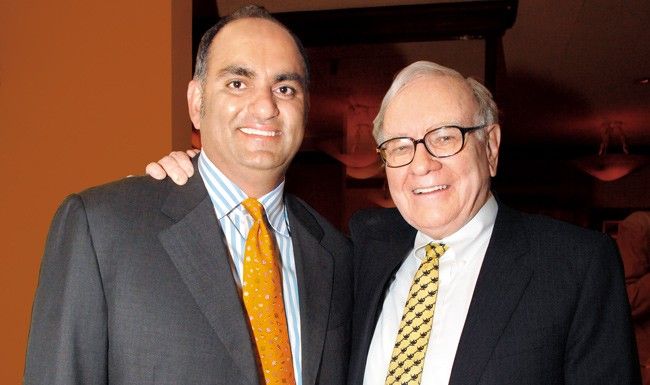

Here, is where he came across Warren Buffett. Wanting to learn from the best, Pabrai personally wrote to Buffett asking for a job. However, due to his age and lack of experience, Buffett turned him down.

Naturally, this crushed Mohnish Pabrai, who went back to work at TransTech. Still somewhat bitter, Pabrai used Buffett’s life as a template for his own, learning as much about Buffett as possible.

Using this information, Pabrai established his own family of hedge funds, Pabrai Investment Funds. He would incorporate these in California, before moving there, with his wife and two daughters that same year.

Mohnish Pabrai would style Pabrai Investment Funds after Buffett’s former hedge fund, Buffett Partnerships. This is a company he would close after he acquired the famed Berkshire Hathaway.

After selling TransTech in 2000, Pabrai invested his own money in the fund.

Even today, over 20 years later, Pabrai is still involved in the day-to-day management of the firm. primarily, this is done through him running their top hedge fund, which he’s done since 1999.

Today

As of the time of writing, Pabrai is still a fairly private individual. As such, we don’t know his exact net worth, however, Finance Friday estimates his net worth to be between $115 and $120 million as of the time of writing.

Today, Mohnish Pabrai is probably most famous for his philanthropy. In 2005, Mohnish and his wife, Harina Kapoor, founded the Dakshana (infinite good) Foundation to help reduce poverty in India.

On top of running his own charitable foundation, Pabrai also paid $650,100 with Guy Spier for a charity lunch with famed investor Warren Buffett, in 2007. Pabrai later said that it was “worth every penny”.

Besides just his philanthropic efforts, Pabrai is still an active investor, both for himself and for his clients. As of the time of writing, Pabrai Investment Funds has a total of $600 million in assets under management.

Thanks to his philanthropy, as well as his talents as an investor, Pabrai has also been the recipient of his fair share of awards. Pabrai’s earliest award was when he won the 1999 KPMG Illinois High Tech Entrepreneur Award.

Since there, Pabrai has become a member of both the Young President’s Organization and the The Indus Entrepreneurs (TIE). Since joining them, Mohnish Pabrai has received numerous accolades from both organizations.

Books

Beyond just being an investor and a philanthropist, Mohnish Pabrai is also an award-winning author too. To date, Pabrai has published two books, both of which have become key reading material for any investor!

In 2004, Pabrai published his first book, Mosaic: Perspectives on Investing. Essentially, this book summarizes the key principles that Warren Buffett uses to invest, but done so in an easy-to-read fashion, with very little jargon.

Three years later, Pabrai would publish a follow-up book. This would be titled, The Dhandho Investor: The Low – Risk Value Method to High Returns, which focuses on applying his own investing principles alongside Warren Buffett’s.

However, it focuses on buying low risk (relatively safe) investments, in order to get high returns over long periods of time.

As of the time of writing, both books have sold thousands of copies and have been translated into hundreds of different languages.

How Can I Replicate What Mohnish Pabrai Did?

Usually, this is the part where I say “You can, but you can’t” and then explain what I mean by that. However, assuming you have the patience to, you can absolutely recreate what Pabrai did, just look at Phil Town!

Pabrai didn’t start investing until his late thirties. For investors, this is extremely late, other investors, such as Warren Buffett, started in their teenage years, with some even younger.

Let’s assume that you’re older than 30 years old. You’re probably looking to start saving for retirement, through having a strong investments portfolio. However, every article you’ve read has told you to start investing as young as possible.

For you, that’s perhaps not as helpful as you’d like. Currently you’re in the middle of your careers, which has its own benefits and drawbacks. If you play your cards right, you’ll be able to become as successful as Mohnish Pabrai!

On the one hand, you’re far enough into your career, that you are likely earning a decent enough salary/wage. However, by the same token, you have also missed out on potentially a decade’s worth of compound interest.

If you invest a large portion of you income each month into solid stocks, you’ll essentially be able to get back the amount of compound interest you would’ve if you’d invested a little, a decade ago.

If you don’t already, start a side business to give you extra funds to invest with.

Assuming you do everything correctly, by the time you’re Mohnish Pabrai’s age, you’ll have a large investments portfolio for you to retire on!

What Can we Learn From Mohnish Pabrai?

The life of Mohnish Pabrai can teach you a lot. This isn’t just about running your own business, but also about personal finances, as well as life in general!

You Have no Excuse

Mohnish Pabrai was born in Mumbai, India on June 12 1964. Yes, he was fortunate to be born into wealthy family, and attend an exclusive private school. But Pabrai was still forced to look elsewhere for better education.

This saw him come to the United States, where he’d go to Clemson University in South Carolina, to study computer science. Here, he would know no one, and spoke English with a fairly thick Indian accent.

However, Pabrai didn’t let this dissuade him. He worked extremely hard, got educated, and went to work for one of the largest IT groups in the local area. This then put him on the path to becoming one of the richest investors in the world…

Over time, Pabrai lost much of his original, thick Indian accent. In its place, he has a mixture of an American and Indian accent, which has allowed him to gain the trust of American and foreign investors alike.

Don’t Forget to Give Back

Mohnish Pabrai has been fortunate to have done extremely well for himself. He has amassed an empire larger than most people could ever dream of, not to mention having more money than he could’ve ever dreamed of either!

However, Pabrai doesn’t sit at home, counting his coins like Scrooge McDuck. Instead, Pabrai is one of the most charitable people in the public eye, even if he hasn’t signed the famous Giving Pledge.

In 2005, Pabrai and his wife Harina, founded his Dakshana Foundation. The goal of the foundation was to use their wealth to help what are known as the “Untouchables” in India, or those in the lowest social caste.

These are often the people who are in the most extreme forms of poverty in India. Pabrai’s foundation provides tutors for them. This is done in the hopes that they will be able to go to universities in the West and pull themselves out of poverty.

Learn From The Best

Pabrai never studied under people like Benjamin Graham. Instead, Pabrai was self-taught, having studied the likes of Warren Buffett religiously, learning the ins and out of investing the same way they do.

In his early days, Pabrai was a follower of copycat investing. Here, he would hold a portfolio that was extremely similar to that of Warren Buffett, whilst also containing a few stocks from other famous investors as well!

From here, Pabrai could use his own experiences with the stock market, and what he had learned from Buffett to formulate a new investment strategy. This is what he’s used to become so rich…

According to Mohnish Pabrai himself, he still regularly follows Warren Buffett in particular. Pabrai continually learns from Buffett, altering his strategy accordingly, to continue to get the best return on investment possible.

Pass on What You Have Learned

Owing much of his fortune from studying Warren Buffett, Pabrai understand the power of knowledge more than most other people on the planet. After all, knowledge is power.

To that end, Pabrai has written numerous investing books. The focus of these books is describing Pabrai’s personal investing strategy, and showing how you could implement his strategy for your own portfolio.

Beyond just writing a series of books, Pabrai is also the author of a blog too. This is called Chai with Pabrai, which he publishes on monthly, often with the help of his alma mater, Clemson University.

Pabrai often visits the business campus of his alma mater to give lectures to the students. His blogs posts are then either transcripts, recordings or the talking points of his talks, which are free for anyone to view!

Money is a Tool

When Pabrai sold TransTech for $20 million, in 2000, he could’ve quite easily retired. Using this $20 million, he could’ve bought himself a nice house (or five!) and lived somewhere tropical. And never have to work again.

However, this isn’t what he did. Instead, Pabrai used his $20 million to make more money. As of the time of writing, Pabrai has turned this $20 million into a $100 million fortune, that’s growing at an average of 16% per year!

On top of this, Pabrai is world renowned for using his money to find more knowledge. This is perhaps best shown when Pabrai spent $650,100 on the aforementioned charity lunch with Warren Buffett.

$650,100 is still a lot of money, even for someone worth $100 million. However, Pabrai knew that having this lunch with Buffett would yield information that he could use to make million of dollars!

Has the story of Mohnish Pabrai inspired you? Tell me in the comments!